Effective Revenue and Expense Tracking: The Ultimate Guide for Entrepreneurs.

Aug 05, 2024

Effective financial management provides insights into your business’s performance, helps in making informed decisions, and ensures financial stability. In this blog post, we’ll delve into the importance of precise revenue and expense tracking, explore strategies to enhance your financial management, and highlight how tools like Worki can streamline this process. By the end, you'll have actionable steps to take control of your finances and boost your business's profitability.

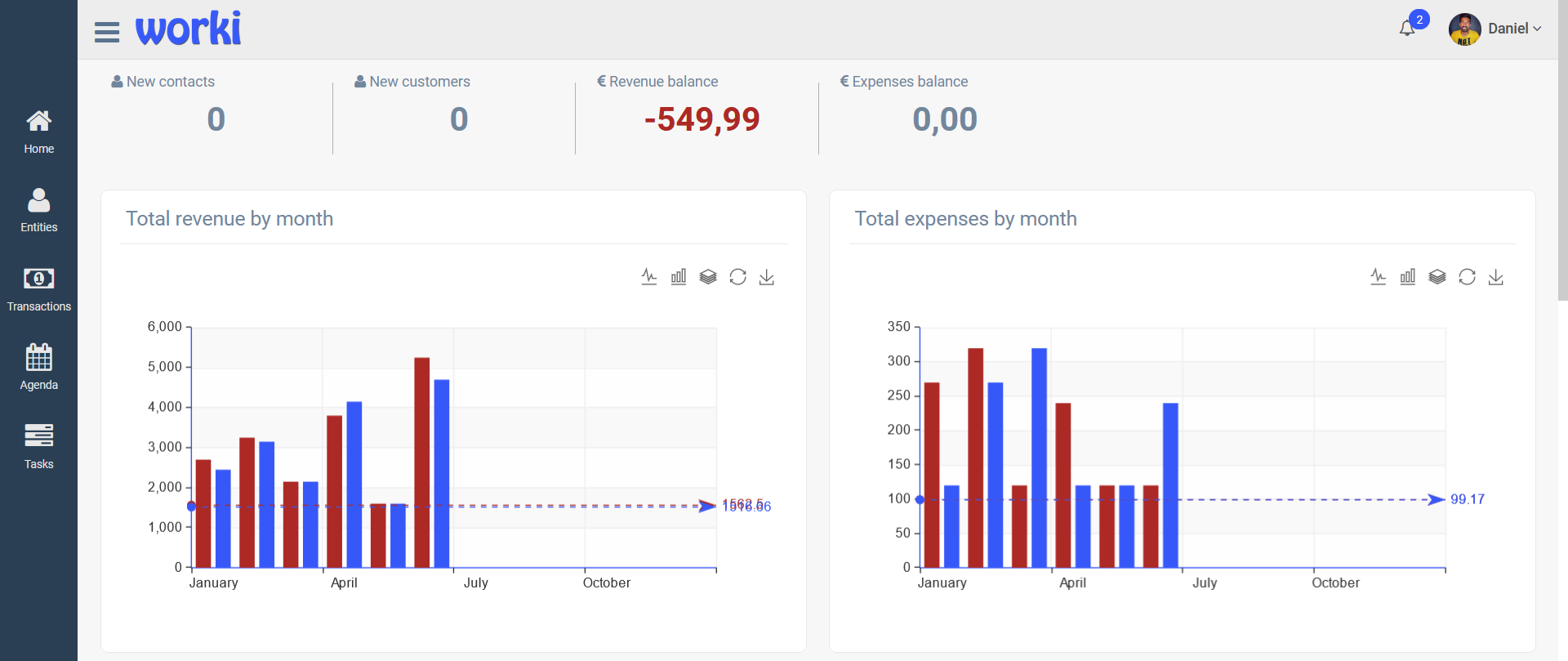

Proper tracking of revenue and expenses provides a clear picture of your business’s financial health. It helps you understand where your money is coming from and where it’s going, which is crucial for making informed decisions.

If you can't measure it, you can't improve it.

"Peter Drucker"

Accurate financial records allow for effective budgeting and forecasting. By analyzing past financial data, you can predict future revenue and expenses, enabling you to plan for growth and avoid potential financial pitfalls.

A budget is telling your money where to go instead of wondering where it went.

"Dave Ramsey"

With accurate financial data at your fingertips, you can make informed decisions about investments, cost-cutting, and growth strategies. This data-driven approach reduces risks and maximizes opportunities.

Good decisions are based on knowledge and not on numbers.

"Plato"

Tracking revenue and expenses meticulously helps you manage your cash flow better. It allows you to identify periods of high expenditure and adjust your spending accordingly to maintain a healthy cash flow.

Beware of little expenses; a small leak will sink a great ship.

"Benjamin Franklin"

Detailed tracking of expenses can reveal areas where you can cut costs without compromising on quality. This can lead to significant savings and improved profitability.

Cutting costs is not about saving money, it's about re-engineering processes.

"N. R. Narayana Murthy"Here are practical strategies for effective revenue and expense tracking:

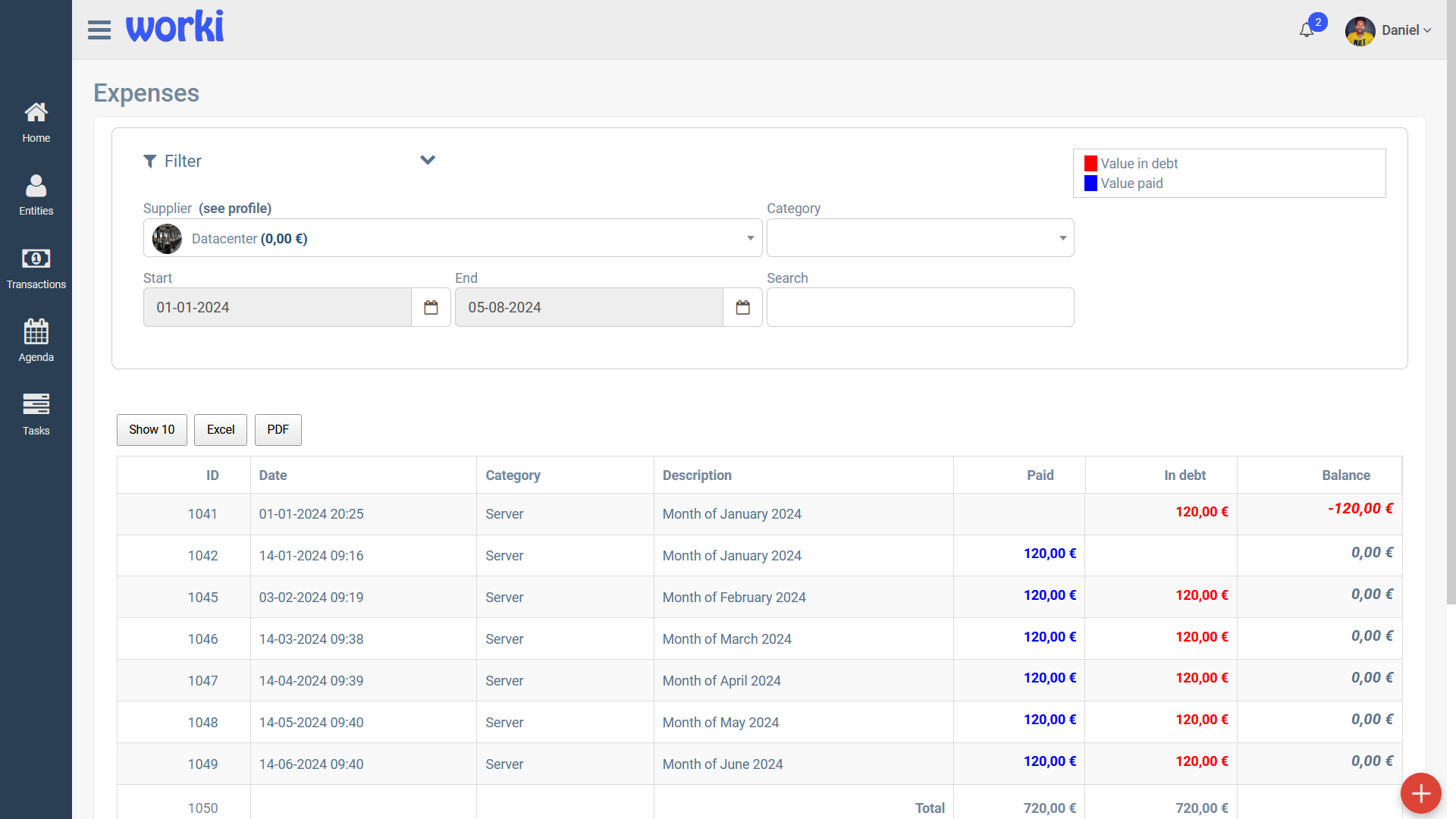

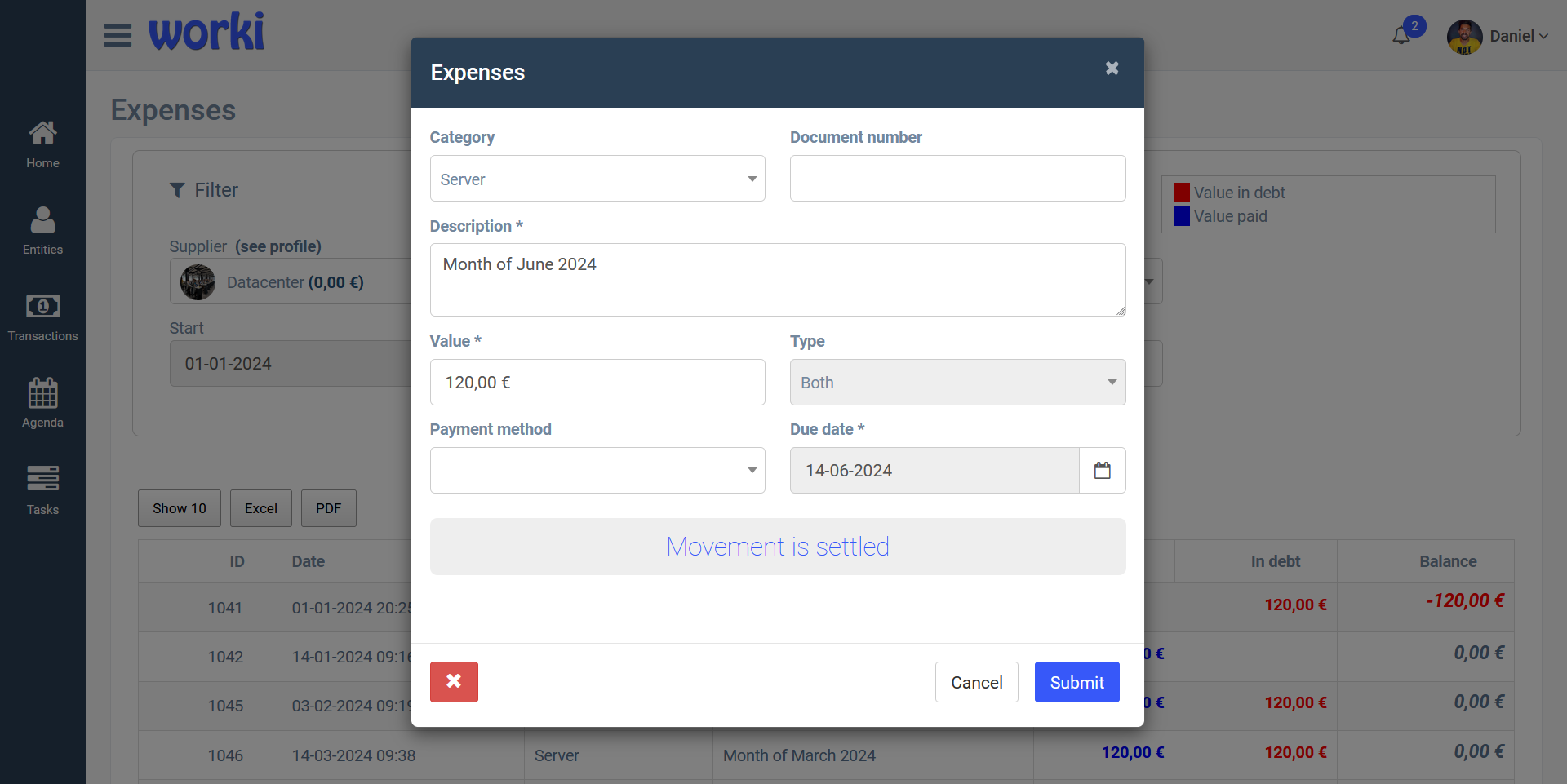

Categorize your expenses to understand where your money is being spent. Common categories include utilities, payroll, marketing, and office supplies. This helps in identifying high-cost areas and making necessary adjustments.

How to Implement:

Create categories for different types of expenses.

Regularly review and update your categories as needed.

The ability to simplify means to eliminate the unnecessary so that the necessary may speak.

"Hans Hofmann"Worki provides and simplifies expense tracking and categorization. Its user-friendly interface and automation capabilities ensure accurate and efficient financial management.

Regularly reviewing your cash flow statement ensures you’re aware of your financial position enabling you to track your progress, identify any discrepancies, and make informed decisions that allow you to take proactive steps and address any issues.

How to Implement:

Review cash flow statements monthly.

Identify trends and adjust your spending accordingly.

Review your goals twice every day in order to be focused on achieving them.

"Les Brown"Real-time tracking of revenue and expenses provides up-to-date financial data, allowing you to make timely decisions. This can prevent overspending and help in quickly addressing any financial issues.

Worki offers real-time financial tracking, allowing you to monitor your revenue and expenses as they happen. This feature ensures that you always have the most current data at your fingertips.

Maintaining detailed records of all receipts and invoices is crucial for accurate tracking and audit purposes.

How to Implement:

Digitize all receipts and invoices.

Store them in a cloud-based system for easy access and security.

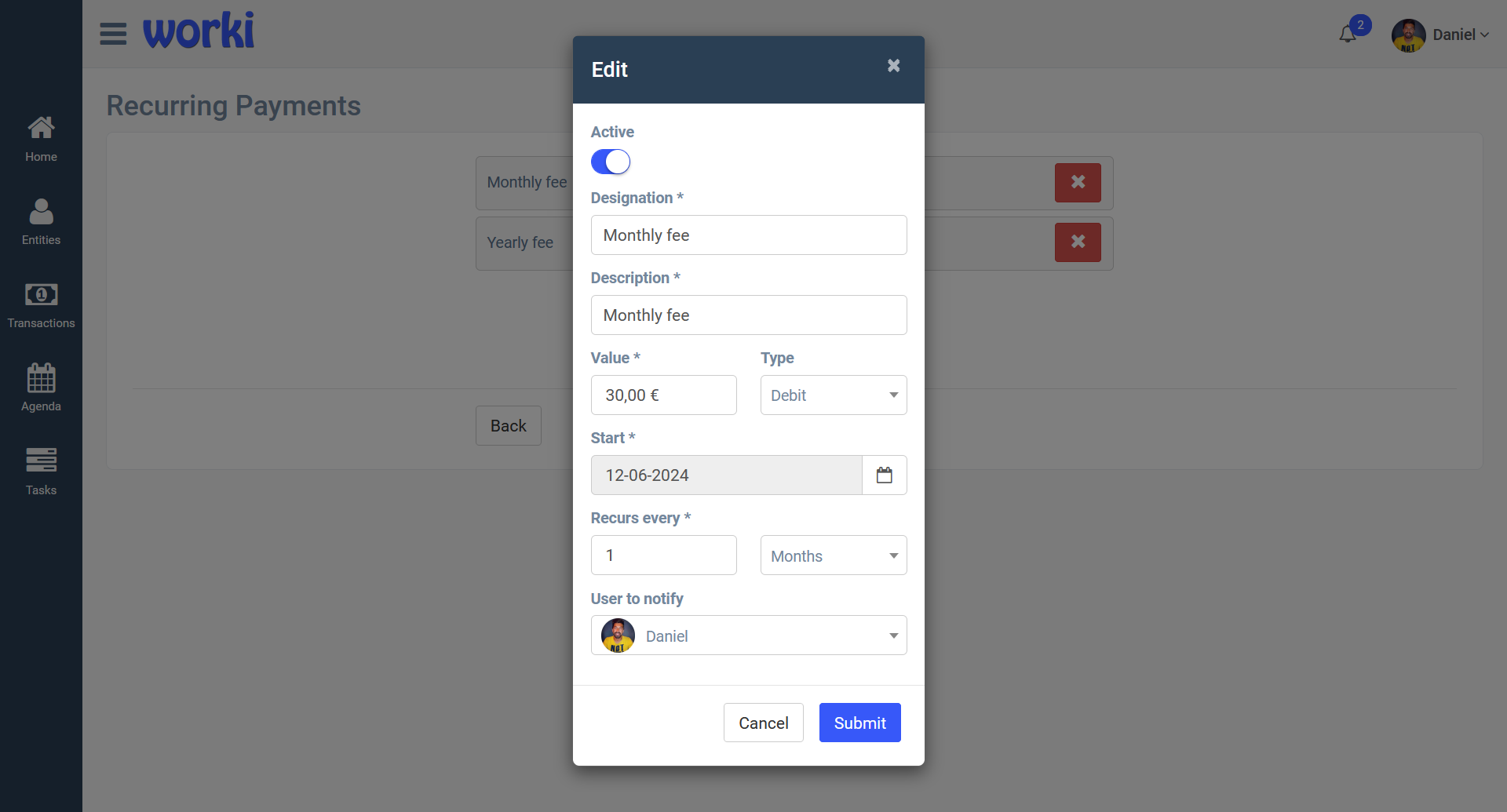

Automating recurring revenue like monthly or yearly fees and expenses like rent, utilities, and subscriptions ensures they are paid on time and reduces the risk of missing payments, which can affect your business’s credit score and incur late fees.

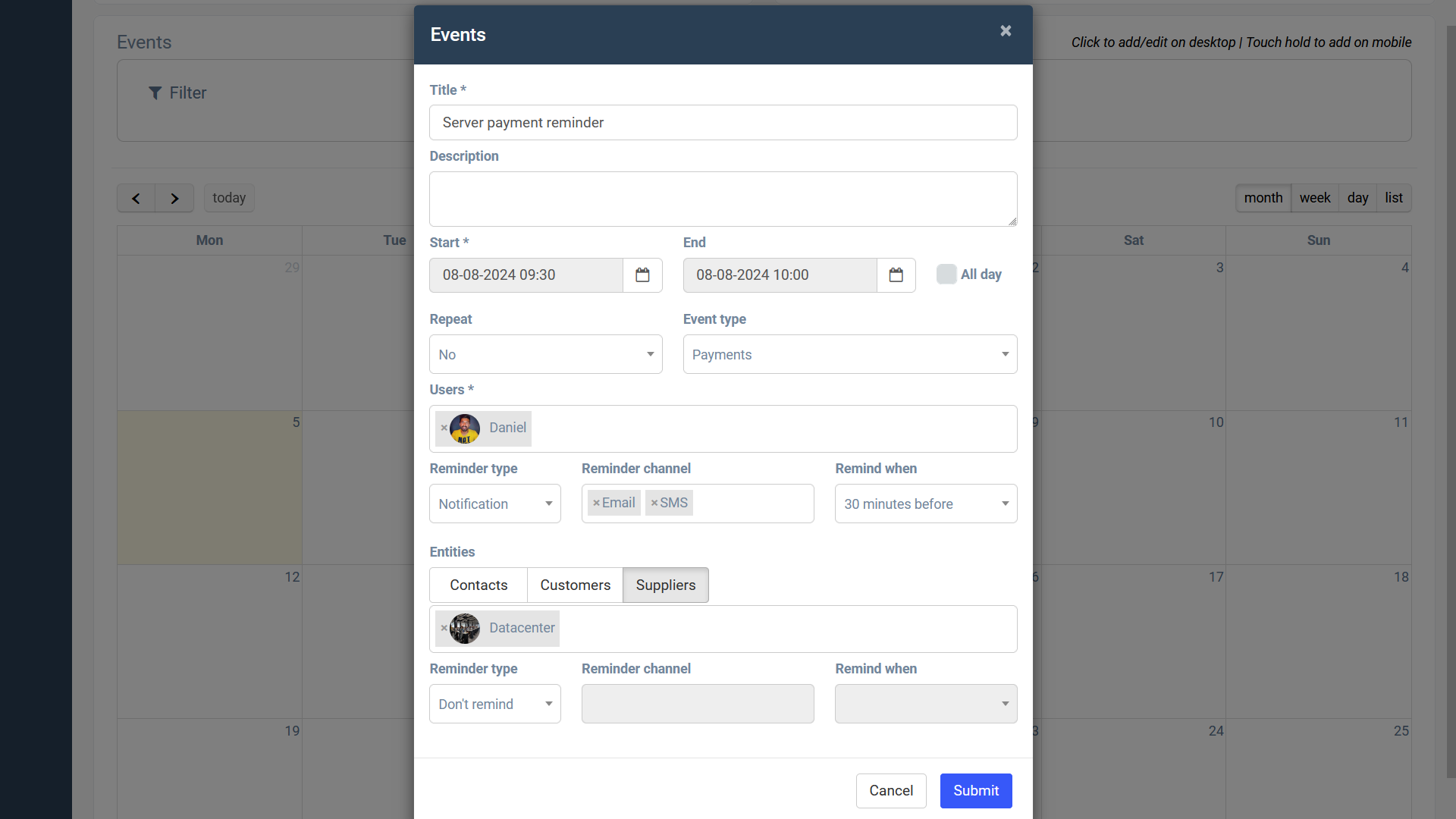

Worki’s automation features allow you to set up recurring subscription based revenue and payments reminders, ensuring that all your regular expenses are automatically tracked and paid.

Setting clear financial goals gives you a target to aim for and helps you stay focused on your revenue and expense management efforts.

How to Implement:

Define short-term and long-term financial goals.

Regularly track your progress towards these goals.

A goal without a plan is just a wish.

"Antoine de Saint-Exupéry"

Identify and monitor financial KPIs that are crucial for your business. Common KPIs include gross profit margin, net profit margin, and operating cash flow. Tracking these metrics helps you understand your business's financial health and performance.

Measure what is measurable, and make measurable what is not so.

"Galileo Galilei"Effective revenue and expense tracking is more than just a bookkeeping necessity, it's a strategic advantage that empowers your business to thrive. By implementing robust accounting systems, categorizing expenses, conducting regular financial reviews, and utilizing real-time tracking, you can gain invaluable insights into your financial health, improve cash flow management, and identify cost-cutting opportunities. These practices not only help in maintaining financial stability but also in driving your business towards sustained growth and profitability.

Ready to take control of your business finances and maximize your profits? Try Worki today and discover how our all-in-one business management solution can help you manage revenue and expenses, client data, streamline tasks, and boost productivity. Sign up now and start transforming your business!

Daniel

Daniel